Although most of us do not have multimillion dollar estates, we still have plenty to protect. Our families and loved ones can be spared financial difficulties and legal proceedings if we do the proper planning today. The following are terms everyone should know in order to protect ourselves and loved ones.

Probate is a court administration of a deceased person’s estate. It is a lengthy proceeding that follows strict procedural formalities as mandated by the California Probate Code. The expense of a probate is based on a percentage of the gross value of the “probate estate” (“gross” meaning the value of the estate not reduced by any debts or mortgages). For example, the combined attorney’s and executor’s fees to probate a $300,000 home (even with a $200,000 mortgage) would be $18,000 plus additional costs averaging $1,800. These fees and costs do not include any other expenses such as taxes.

A Revocable Living Trust is a legally binding contract wherein the creator of the trust (called the “settlor,” “grantor,” or “trustor”) enters into an agreement with the trustee to manage the settlor’s assets for the benefit of the “beneficiary” (the person receiving the benefit of the assets). Typically, the settlor is the initial trustee and initial beneficiary of the trust. If assets are properly in trust at the settlor’s death, then those assets avoid probate.

A Last Will and Testament will be used to transfer certain assets into your trust at the time of your death (called a “pour-over will”). If you do not have a trust, the will transfers certain assets to the named beneficiaries of your will. If the value of the assets controlled by the will exceed $150,000 (gross), then the will must be probated before assets are distributed to your trust or your beneficiaries. In other words, a will does not avoid a probate proceeding. The creator of the will is called the “testator.” The testator nominates an “executor” to administer the will, however, only the probate court appoints the executor to administer the will.

Guardianships are necessary if you have minor children. You should nominate who will physically take care of your children (called a “guardian of the person”) and who will manage your children’s inheritance (“guardian of the estate”). This nomination is provided in your will and the court must approve the nomination. Only the court has the actual authority to appoint the guardian, but it gives deference to those you have nominated. It is wise to nominate a series of alternate guardians to serve.

Children’s Trusts & Special Needs Trusts are specialized tools used to protect the inheritances of children with special needs, under-aged children, or even adult children who may need financial guidance. The use of these “support trusts” can be customized to address the parent’s concerns. These are generally sub-trusts of the parent’s living trust or will that hold the child’s inheritance for his/her benefit after the death of the parent(s). If the child is disabled and receiving public benefits (such as SSI and/or Medi-Cal), a special needs trust can be established so the child’s benefits are not lost or paid back to the state.

A Durable General Power of Attorney allows the “principal” (the person creating the document) to appoint an “agent” (attorney-in-fact) to manage assets held in the principal’s individual name, such as retirement accounts, vehicles, or life insurance policies. It typically does not allow the agent to manage or access assets held in the revocable living trust (only the trustee can). A “springing” durable general power of attorney only goes into effect once the principal becomes incapacitated; whereas an “immediate” durable general power of attorney becomes immediately effective once the principal signs it.

An Advance Health Care Directive/Power of Attorney for Health Care allows the principal to designate an agent to make health care decisions on the principal’s behalf if he or she is unable to. It also contains a written set of instructions or guidelines about the principal’s wishes regarding life-sustaining treatment. Anyone 18 years or older should have one.

Having a basic understanding of estate planning terms is your first step in implementing an appropriate plan for your family. Although each plan is unique, you can expect to pay between $1,500-$3,500. To ensure your estate plan is properly executed in accordance with your wishes, hiring an attorney is worth the investment.

Posted in: Community

Comment Policy: All viewpoints are welcome, but comments should remain relevant. Personal attacks, profanity, and aggressive behavior are not allowed. No spam, advertising, or promoting of products/services. Please, only use your real name and limit the amount of links submitted in your comment.

You Might Also Like...

Before, During and After a Wildfire

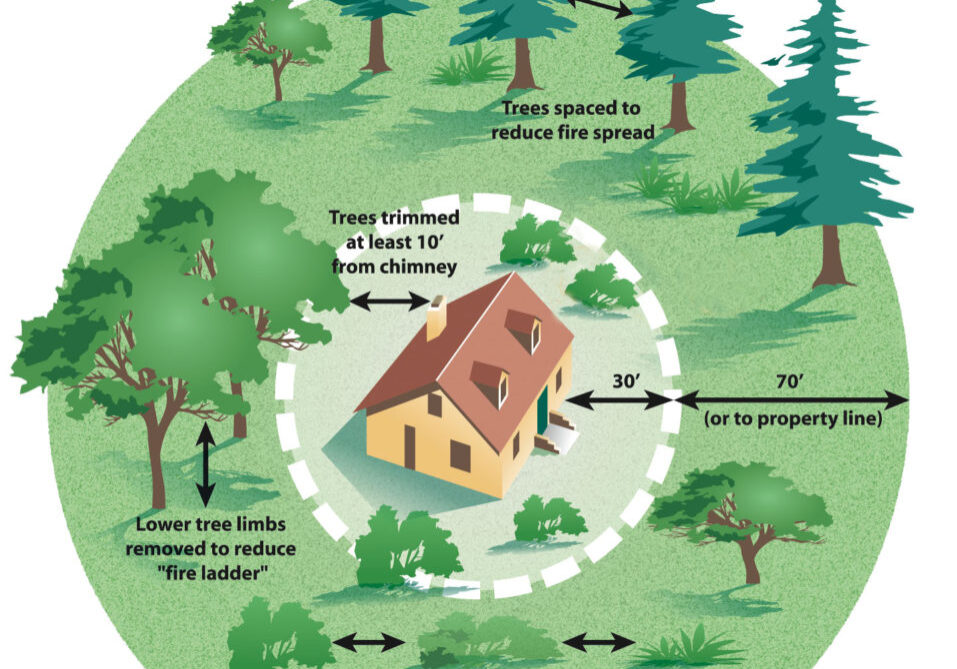

Wildfire Actions What to do BEFORE a wildland fire: Create defensible space to separate your home from flammable vegetation and materials (minimum 100ft PRC 4291). Adhere to all local fire […]

Working Memory And The Learning Brain: What It Is and Why It Matters

Working with a child as he learns a new skill can be a rewarding experience for a parent or teacher. It can also be one filled with unexpected challenges, requiring […]

Be More Than A Hero… Be a SUPERHERO! – Join the CASA Superhero Runs in Chico and Redding

Heroes will not be hard to find in the North State this month and next: they’ll be out in the open, running for a good cause and having fun in […]

This Season’s Harvest Happenings

Autumn is here and it’s time to begin or continue a traditional visit to harvest events in our region. Pumpkins, colorful gourds and winter squash all provide a cornucopia of […]